OVERVIEW実施概要

- Date & Time

- Monday, April 11, 2022

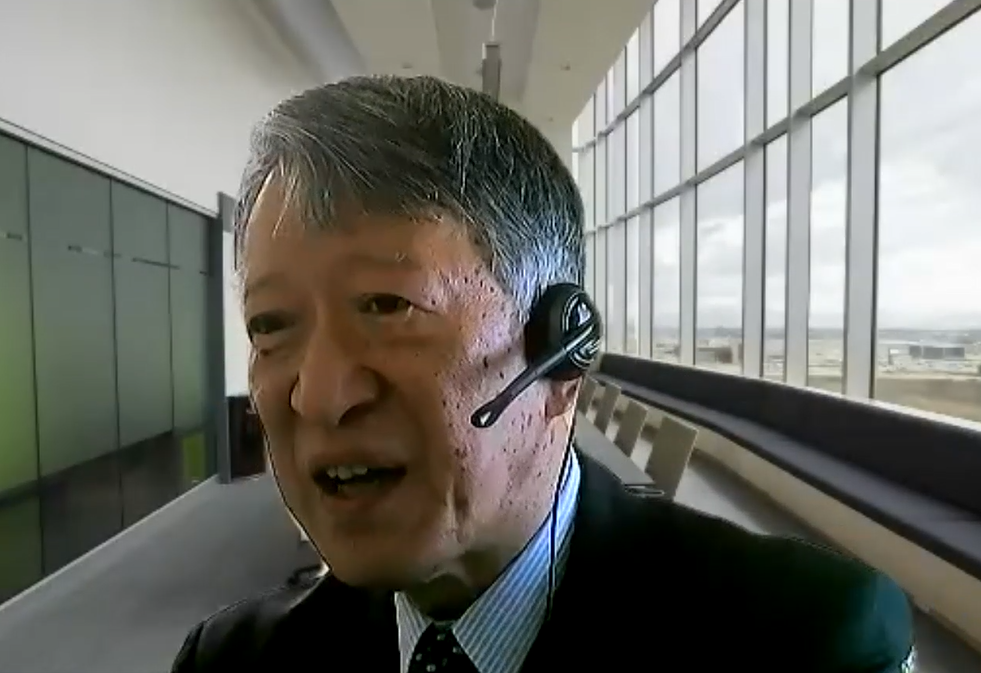

Video report: The Tokyo Stock Exchange Restructuring’s Impact on Japanese Companies and the Economy (Professor Hideki Kanda, Faculty of Law, Gakushuin University)

On April 4, 2022, the Tokyo Stock Exchange (TSE) will be restructured from its current four market segments to three market segments: Prime, Standard, and Growth. Companies listed in the Prime Market will require a high degree of transparency and corporate governance as global companies, such as increased disclosure requirements for information related to sustainability, including measures to deal with climate change. What impact will this restructuring have on Japanese companies, and the economy as a whole? Will this restructuring eliminate concerns over the TSE being unable to recover from its decline after the collapse of Japan’s economic bubble, and becoming just another regional stock exchange?

The FPCJ invited Professor Hideki Kanda of Gakushuin University, who took the lead in this restructuring, to discuss this topic. Professor Kanda is chair of the TSE’s Advisory Group on Improvements to TSE Listing System, as well as chair of Financial System Council working groups.

The briefing had a total of 26 participants including journalists from Brazil, France, Hong Kong, Singapore, UK and US.

Handouts (Japanese) Handouts (English) Follow-up Answer

■Date: April 11 (Mon.), 2022, 14:00-15:30

■Theme: The Tokyo Stock Exchange Restructuring’s Impact on Japanese Companies and the Economy

■Briefer: Professor Hideki Kanda, Faculty of Law, Gakushuin University

■Language: Japanese, with consecutive English translation

[Note]

If you have published an article, photo, or a program based on our press briefing report, please provide us with the (1) title of article(s) or product(s), (2) author’s name, (3) published/broadcast date of your report, and (4) a copy of or a link to your report (if available) via email (cp[at]fpcjpn.or.jp).

*Please replace “at” with “@” when you send the e-mail.